Out of this supplies costing 150 remained unused on 31 December 2016. In the companys books.

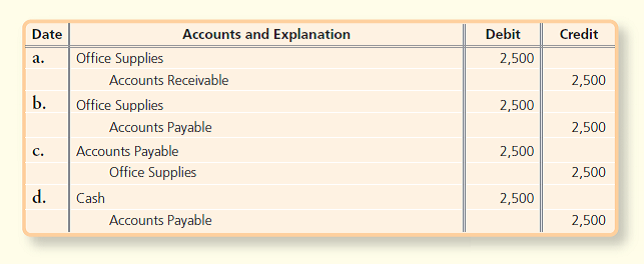

Answered Date Accounts And Explanation Debit Bartleby

The normal accounting for supplies is to charge them to expense when they are purchased using this entry.

. Make a journal entry on 1 January 2016 when the office supplies are purchased. Debit the Inventory or other asset account for the value of the goods purchased and credit the Letter of Credit account for the payment issued by the bank. This journal entry eliminates the cash or credit reserved for the letter of credit and records an asset for the inventory or other resources received from the transaction.

When cost of supplies used is recorded. When supplies are purchased 2. Make an adjusting entry on 31 December 2016 to record the supplies expense.

The Agricultural Experience Tracker AET is a personalized online FFA Record Book System for tracking experiences in High School Agricultural Education courses. If the cost of the supplies that you have purchased and not yet consumed is significant then you can instead record them as an asset using the following entry.

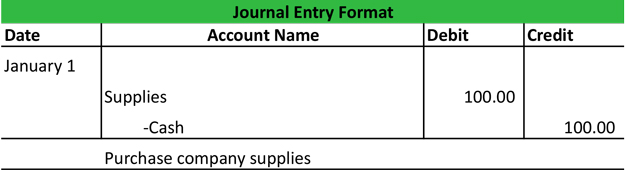

Business Events Transaction Journal Entry Format My Accounting Course

Paid Cash For Supplies Double Entry Bookkeeping

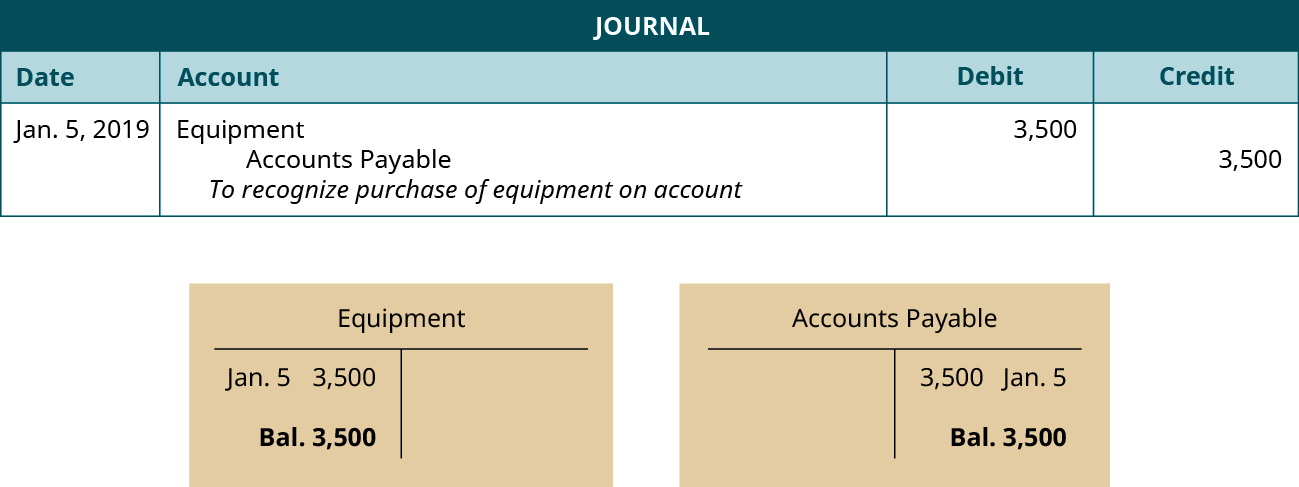

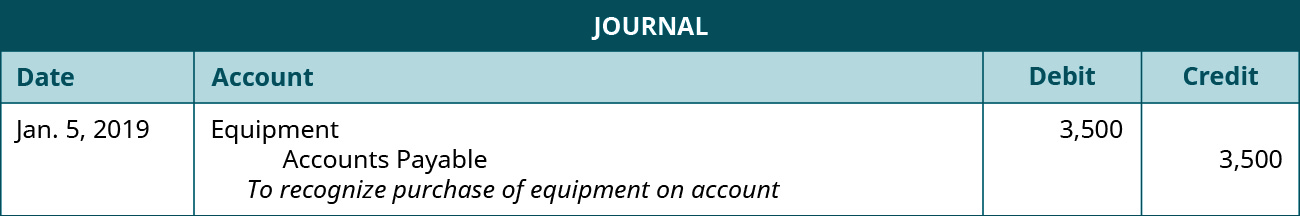

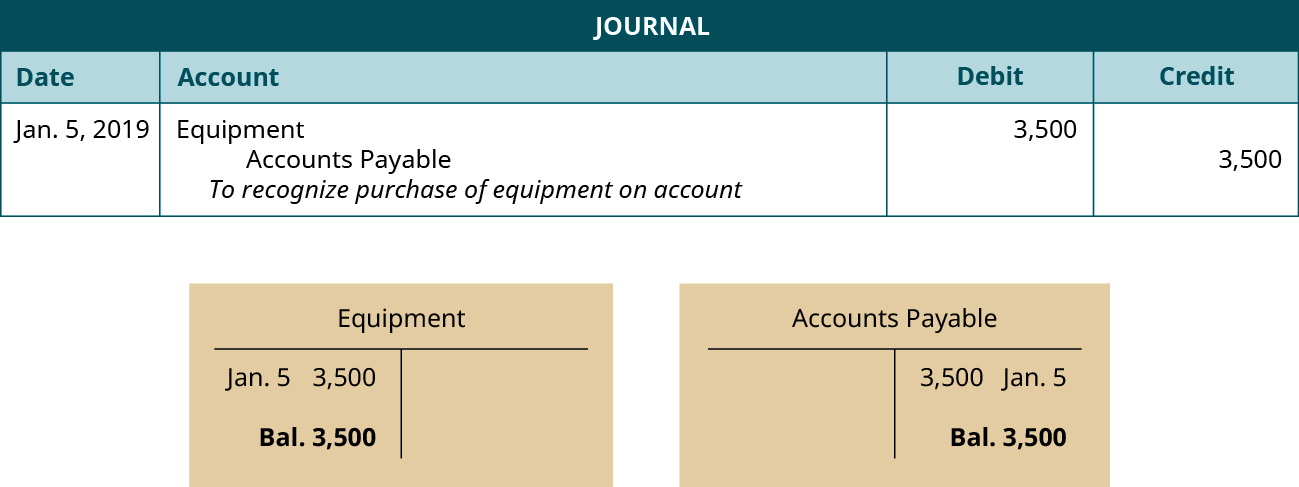

Use Journal Entries To Record Transactions And Post To T Accounts Principles Of Accounting Volume 1 Financial Accounting

Recording Purchase Of Office Supplies Journal Entry

Purchase Office Supplies On Account Double Entry Bookkeeping

Use Journal Entries To Record Transactions And Post To T Accounts Principles Of Accounting Volume 1 Financial Accounting

Recording Purchase Of Office Supplies On Account Journal Entry

0 komentar

Posting Komentar